portability estate tax deadline

Beyond the unique opportunity that Revenue Procedure 2017-34 creates for couples where one spouse already passed away the good news of the new rules is that it effectively turns what is normally a 9-month deadline to file a Form 706 estate tax return just to claim portability into a 2-year deadline instead. However the IRS just issued Revenue Procedure 2014-18 which allows eligible estates an extension through December 31 2014.

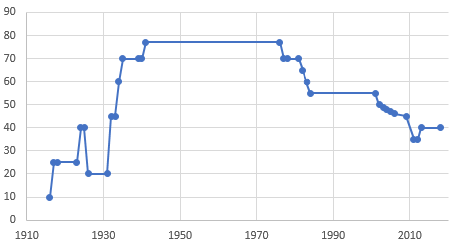

Estate Tax In The United States Wikiwand

The deadline to file an application for portability is March 1.

. The form must be submitted no more than nine months after the deceaseds death. However an automatic six-month extension can be. Bob dies first in 2020 and the federal estate tax exemption is 1158.

6018a with a due date of nine months after the decedents death or the last day of any period covered by an extension obtained under Regs. Under the Act the estate tax exemption is portable between spouses. But this summer the IRS has amended.

202010-2a1 estates electing portability are considered to be required to file Form 706 under Sec. A portability election must be made by filing an estate tax return IRS Form 706 within 9 months from date of death. It is important to note that the deadline for filing an estate tax return is nine 9 months after the decedents death.

Portability of the estate tax exemption between spouses is not in effect. The typical due date for filing a federal estate tax return is on the nine month anniversary of the date of death of the deceased spouse. If the size of the decedents estate is large enough to trigger the mandatory requirement to file a federal estate tax return the deadline to elect portability is the same.

The return is due nine months after death with a six-month extension option. To allow time for processing please wait at least 9 months after filing Form 706 to request a closing letter. Earlier relief for late returns was granted but only through December 31 2013.

To obtain a portability election extension they can file a complete Form 706 by January 2 2018 or the second anniversary of the decedents death whichever is later. To secure these benefits however the deceased spouses executor must have made a portability election on a timely filed estate tax return. As a result if the estate would have filed a return only to elect portability but failed to file within nine months of death 15 months including an extension the procedures allow the estate to complete a letter ruling request for additional time to file the return and make the portability election.

For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021. The due date for filing an estate tax return is nine months after the date of death with an automatic six month extension if requested by the nine month due date. Under the new law however many more estates will suddenly be faced with the need to pay attention to a tax deadline even when no estate tax is due.

The following are five tips about Estate Tax Portability And CA Estate Administration. Important points to consider when filing for Portability. The estate tax return must inc.

2017-34 2017-26 IRB which provides a more liberal timeframe for certain estates to make the federal. However the surviving spouse faces strict filing deadlines for filing the Form 706 making the portability election - such return must be filed within nine 9 months of death plus an additional 6-month period if a valid extension is obtained. The deadline to file a Form 706 is nine months after death with an automatic six month extension available.

Its all too easy to go past the deadline especially if an estate tax return is not required by the IRS. As unlike the normal option for a 6-month. To transfer your assessment difference you must have established a new homestead on or before January 1 of the third year after abandoning your previous homestead.

However in order to elect portability an estate tax return must be filed even if the assets are less than the exemption amount. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. The portability election must be filed on a Form 706 by the the date a normal federal estate tax return must be filed 9 months after the date of death or 15 months with an automatic 6 month extension However taxpayers who do not have taxable estates currently under 5490 million may forget to file such a return to elect portability.

For a surviving spouse to properly make the election to use the deceased spouses unused estate tax exemption the surviving spouse must timely file IRS Form 706 United States Estate and Generation-Skipping Transfer Tax Return. Deadline Extended for Estate Tax Exclusion Portability Opt-In February 25 2014 Estate Planning Taxes The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 was passed in December of that year. Their net worth is 18 million.

When no estate tax is due the sole effect of filing a 706 is to preserve DSUE for the survivor. If more time is required the estate can file for an extension for up to six months. Assume Bob and Sue are married and tall their assets are jointly titled.

What happens if I missed the Filing Deadline. Instead of an estate tax closing letter the executor of the estate may request an account transcript which reflects transactions including the acceptance of Form 706 and the completion of an examination. The Estate Tax Without Portability.

Form 706 is due on or before nine months after the deceased spouses date of death. A six month extension is possible. If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six month extension of time for filing the estate tax return had been obtained the availability of an extension of time to elect portability of the DSUE amount depends on whether the estate has a filing requirement.

New Extended Deadlines for Portability Election Filing On June 9 the IRS issued Rev.

Form 706 Extension For Portability Under Rev Proc 2017 34

Form 706 Extension For Portability Under Rev Proc 2017 34

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Understanding Qualified Domestic Trusts And Portability

Form 706 Extension For Portability Under Rev Proc 2017 34

New Irs Requirements To Request Estate Closing Letter

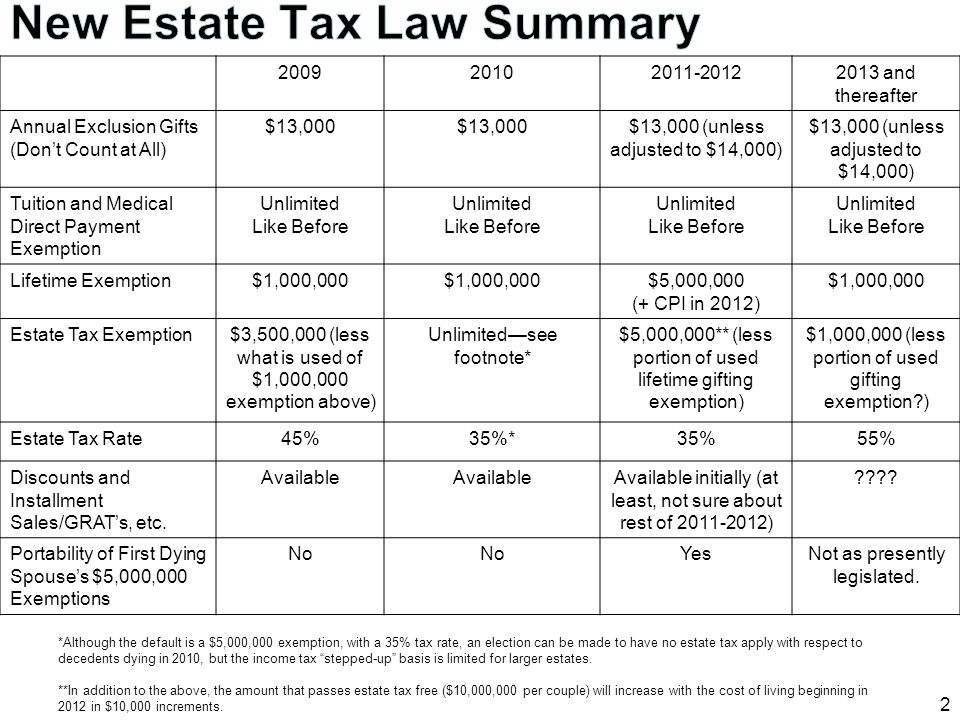

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Estate Tax In The United States Wikiwand

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors