are assisted living expenses tax deductible in 2019

Assisted Living for a Qualifying Relative. If the resident is in the assisted living facility for custodial and not medical care the costs are deductible only to a limited extent.

Tax Deduction For Medical And Dental Expenses The Official Blog Of Taxslayer

Prepare your 2019 Indiana state return for 1799.

. Qualifying relatives include your siblings and their children. Ad Free prior year federal preparation. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019.

Conditions to Be Met for Senior Living Medical Expenses to Be Tax-Deductible. For example if your AGI was 50000 last year then you can claim the deduction for the amount of medical expenses that exceed 3750. For information on claiming attendant care and the disability amount see the chart.

If medical expenses are more than 75 of your adjusted gross income they are considered tax-deductible. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. In order for room and board expenses to be tax deductible the resident must be considered.

The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care. You can include in medical expenses the cost of medical care in a nursing home home for the aged or similar institution for yourself your spouse or. In any case the expenses are not deductible if they are reimbursed by insurance or any other programs.

If that individual is in a home primarily for non-medical reasons then only. These expenses must be itemized and unreimbursed often including assistance with activities of daily living meal preparation and household cleaning. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill.

You can also see the examples. Tax Deductions for Assisted Living Expenses. Obviously your own medical expenses are tax deductible and the same for your spouse and children.

In an online QA the IRS says that nursing home expenses qualify as deductible medical. Which means a doctor or nurse with diagnosing abilities has stated that the patient cant perform at least two daily necessities for their self-care cleaning themselves using the toilet alone. Medical expenses generally make up at least a portion of the monthly service fees and entrance fees at assisted living communities.

There are special rules when claiming the disability amount and attendant care as medical expenses. June 4 2019 148 PM. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Calculate your net federal tax by completing Step 5 of your tax return to find out what is more beneficial for you. In order for assisted living expenses to be tax deductible the resident has to be considered chronically ill This means that they cannot perform two or more activities of daily living eating toileting.

Yes the payments are deductible under medical expenses. The Health Insurance Portability and Accountability Act HIPPA of 1996 ensured that qualified long-term care services may be tax deductible. As mentioned earlier medical expenses for senior living may be tax-deductible if specific conditions are met for each resident.

Nursing home expenses are fully tax deductible when the patient is in a home out of medical necessity. Special rules when claiming the disability amount. You can include the cost of medical care and nursing care cost of meals and lodging in the catered living if the primary reason for being there is to get medical care.

Chronic Illness and Tax Deductible Status. As we mentioned earlier in order for any of your assisted living expenses to be considered tax-deductible medical expenses they must exceed the IRSs threshold of 0075 or 75. The deduction of 39600 48600 9000 should help out a.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. See the following from IRS Publication 502. So if your total medical expenses are 50000 only expenses exceeding 3750 would be eligible for a deduction.

Simply add up the annual cost of. IRS Publication 502 allows all medical and dental expenses to be deducted that cost more than 75 percent of adjusted gross income. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid during the 2020 tax year.

You can also subtract the medical expenses of qualifying relatives from the final amount of taxes you need to pay. Children caring for their disabled parents can qualify for assisted living expense deductions if their elderly parent is a dependent and the child pays at least 50 percent of all health care expenses for. To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug expenses.

However it depends on what that amount includes and why an individual is in catered living. Yes in certain instances nursing home expenses are deductible medical expenses. If Dad figures adjusted gross income of say 90000 then he can deduct the expenses over 10 of 90000 9000.

How To Deduct Home Care Expenses On My Taxes

One Giant Step Forward In Chinese Iit Reform International Tax Review

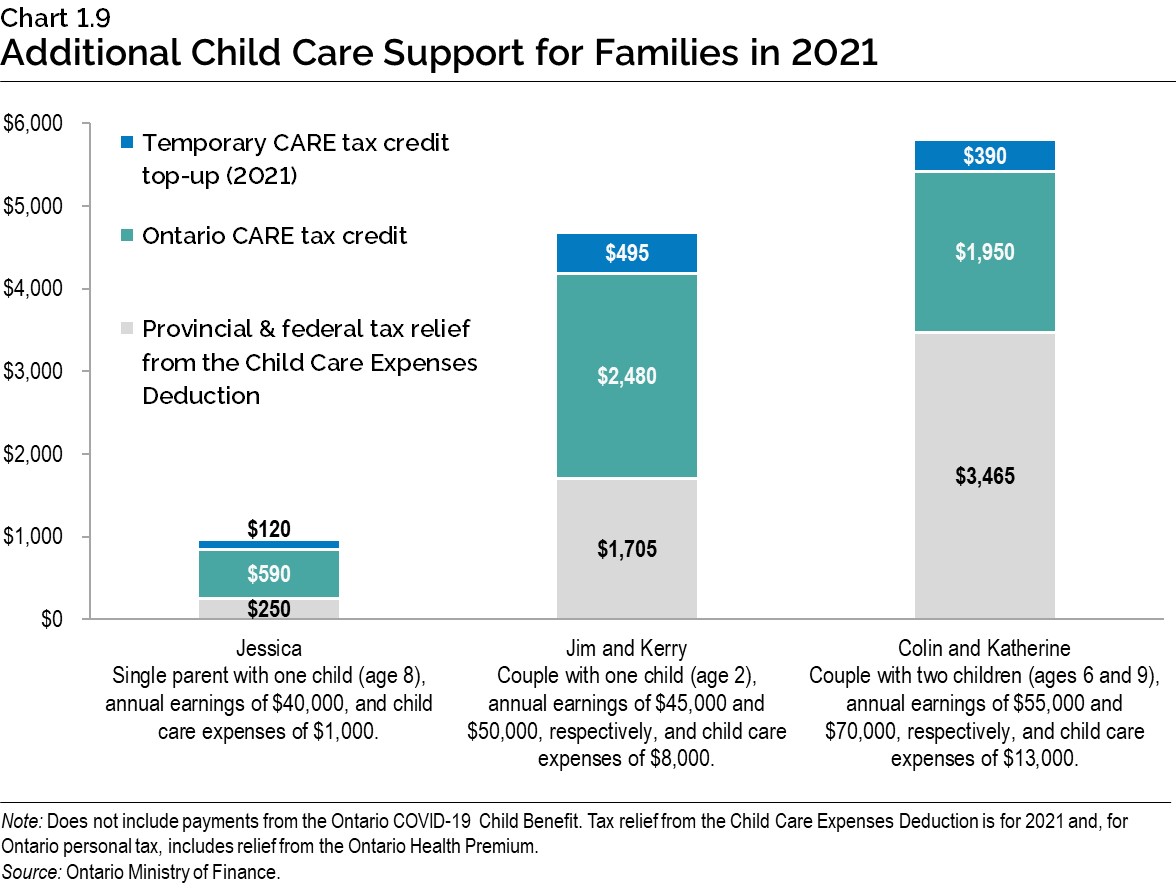

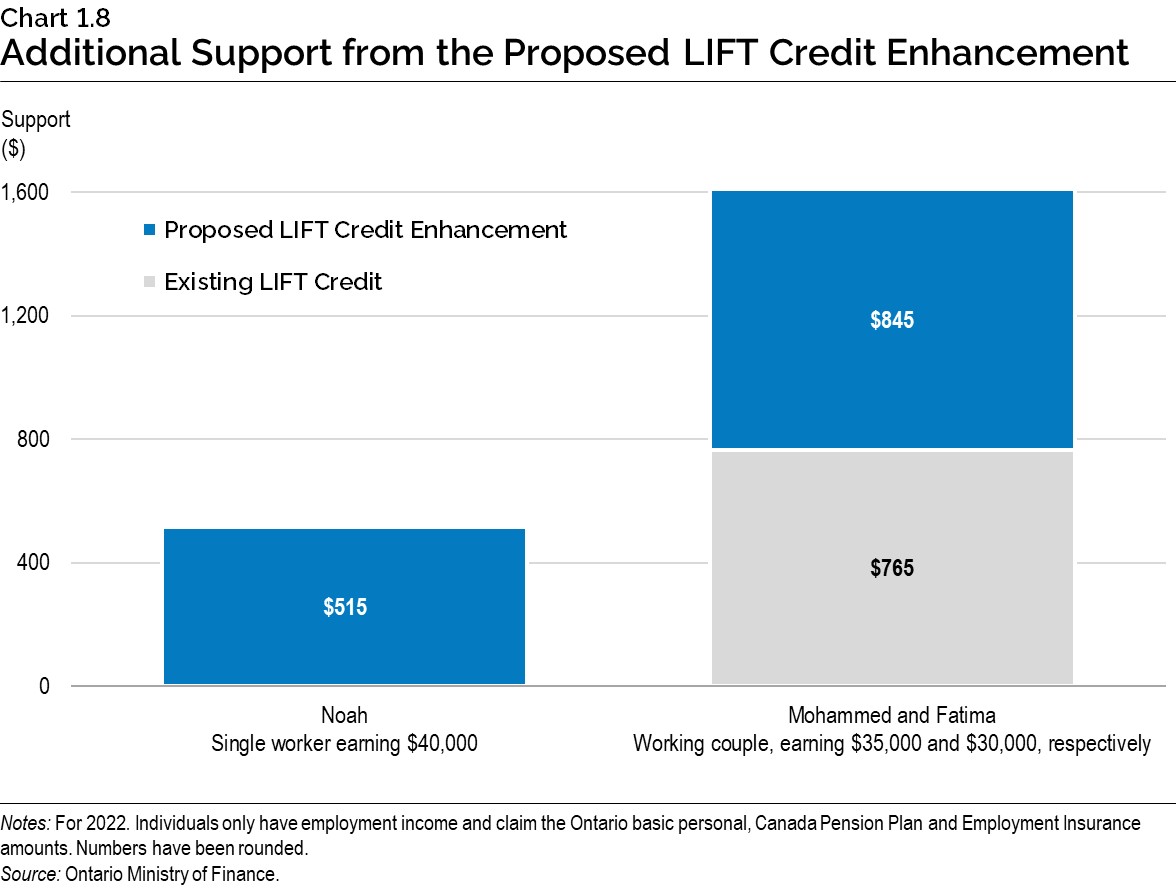

2022 Ontario Budget Chapter 1d

Is Long Term Care Insurance Tax Deductible Goodrx

One Giant Step Forward In Chinese Iit Reform International Tax Review

Creating A Budget For Senior Living Five Star Senior Living

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

2022 Ontario Budget Chapter 1d

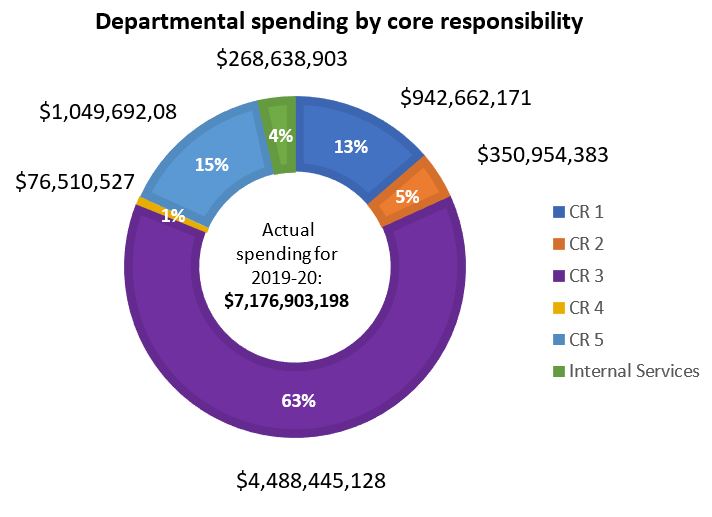

Departmental Results Report 2019 20

Health Care And Your Taxes What S The Connection Turbotax Tax Tips Videos

2019 20 Departmental Results Report

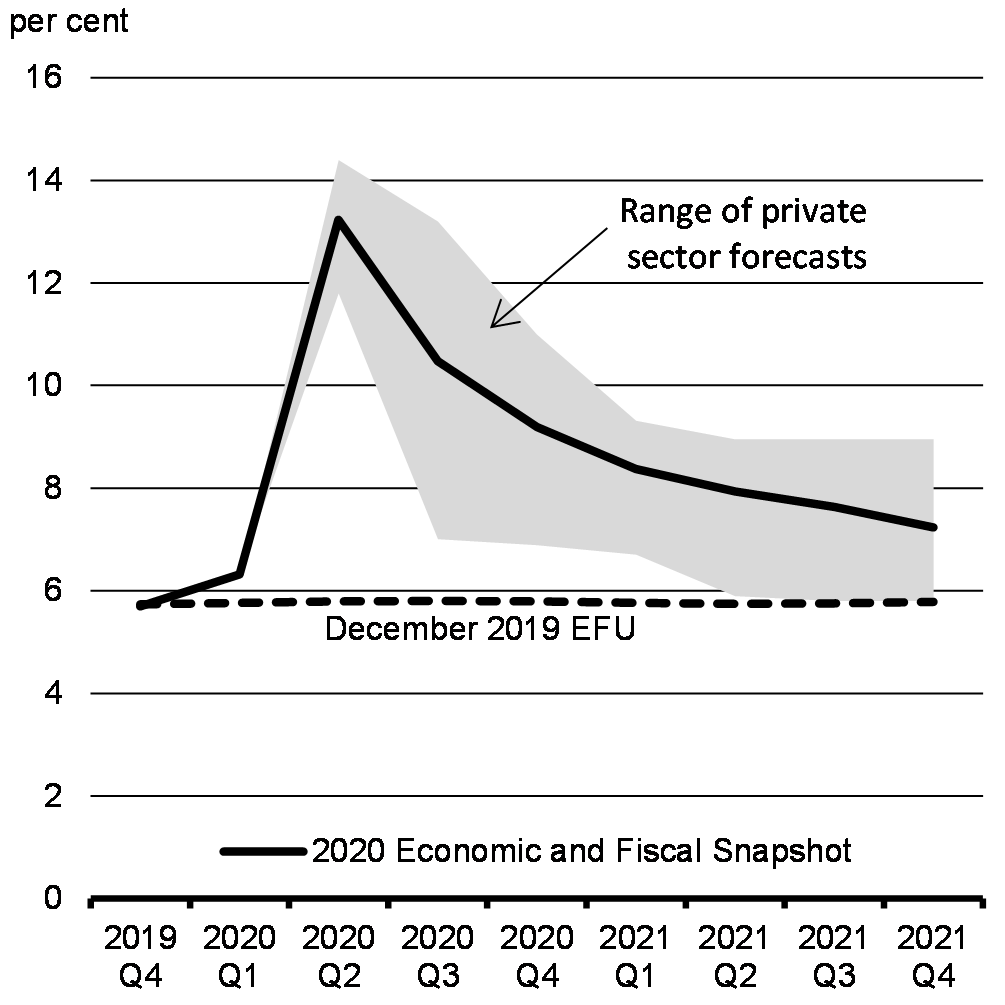

Details Of Economic And Fiscal Projections Canada Ca

How To Deduct Home Care Expenses On My Taxes

Government Grants For Seniors Senior Benefits Canada Homeequity Bank